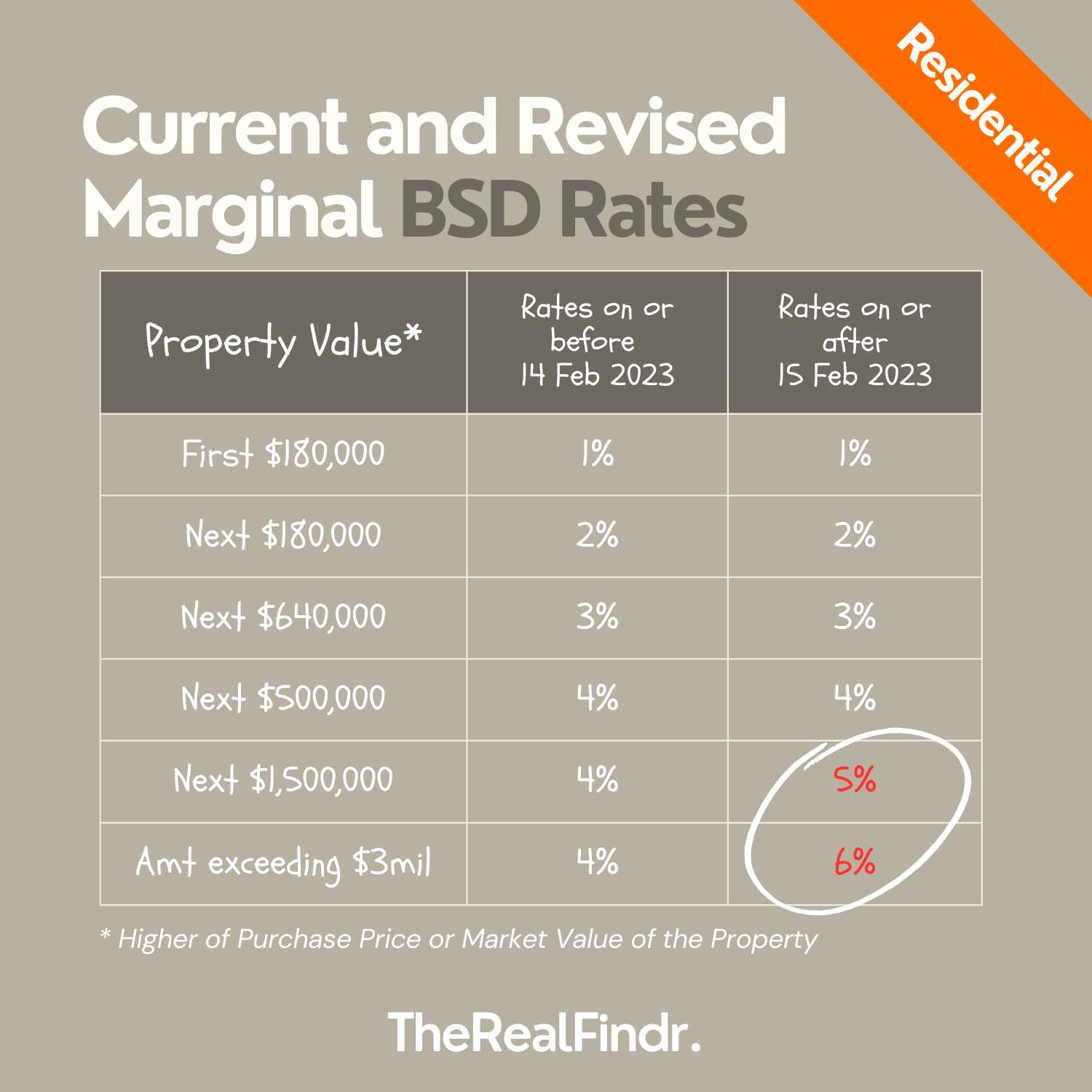

The Government announced on 14th February 2023 that the top marginal Buyer's Stamp Duty (BSD) rate for residential and non-residential properties will be raised to enhance the progressivity of the BSD regime.

For residential properties, the portion of the value of the property in excess of $1.5 million and up to $3 million will be taxed at 5%, while that in excess of $3 million will be taxed at 6%; up from the current rate of 4%.

For non-residential properties, the portion of the value of the property in excess of $1 million and up to $1.5 million will be taxed at 4%, while that in excess of $1.5 million will be taxed at 5%; up from the current rate of 3%.

The revised BSD rates will apply to all properties acquired on or after 15th February 2023. The following Tables summarise the adjustments to the BSD rates.

A transitional provision will allow for the application of the previous BSD rates for cases that meet the following conditions:

- The Option to Purchase (OTP) was granted by sellers to potential buyers on or before 14th February 2023.

- This OTP is exercised on or before 7th March 2023, or within the OTP validity period, whichever is earlier.

- This OTP has not been varied on or after 15th February 2023.

Please note that this information is accurate as of the Government’s announcement on 14th February 2023, and it’s important to stay updated with the latest regulations and policies in the Singapore property market for making informed investment decisions. Seeking professional advice from real estate agents, tax consultants, or legal advisors is recommended to fully understand the implications of the revised BSD rates on individual property transactions.